Silver Squeeze Tightens, Metals' Price Volatility Attracts Energy Traders

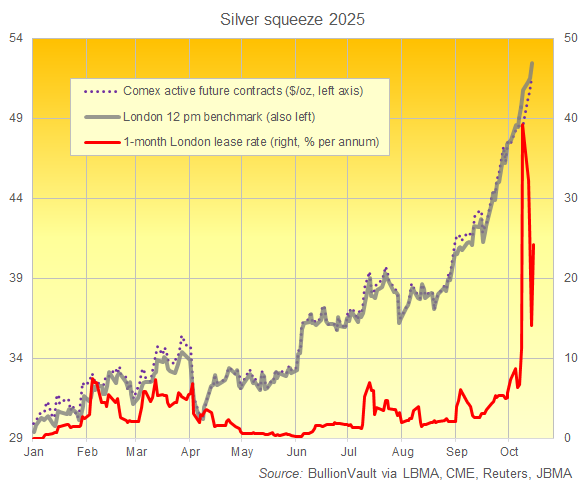

The SILVER SQUEEZE in London bullion trading continued on Wednesday as the industrially-useful precious metal rose to another fresh record price alongside gold, while global stock markets bounced to a 1-week high.

The boom in precious and base metal prices, as well as volatility, is attracting new flows from energy trading houses, according to attendees of London's LME Metals Week.

Crude oil today held near 5-month lows around $62 per barrel of Brent.

Copper rallied to $5 per pound on CME futures contracts, a new record high when reached in the run-up to the returning Trump administration's 'Liberation Day' trade tariffs announcements, but 14.0% below July's spike in US copper derivatives prices.

Silver in contrast set its 4th new record benchmark price in a row, fixing above $52.46 per Troy ounce at midday in London, the world's central trading and storage hub for precious metals.

Gold bullion meantime peaked above $4200 per ounce, adding over $200 for the week so far, before easing back but setting a new record London benchmark price for the 8th day in 11 sessions so far in October.

One-month lease rates to borrow gold in London have now been positive for 2 weeks running, slipping from 0.6% to 0.3% annualized on Wednesday.

Silver 1-month lease rates meantime halved to 14.1% overnight before rebounding to 24.2%, remaining historically high as silver market conditions stay tight.

The discount to London prices in New York silver futures also widened, growing by 10 cents per ounce as the December Comex silver contract traded $1 lower than wholesale bullion quotes.

London bullion's total trading volumes in gold and silver rose only slightly last week, new data said Wednesday from trade association the LBMA, up 0.9% and 2.1% respectively by ounces as prices jumped 2.3% and 6.6%.

That followed the prior week's surge of 24.4% in gold trading and 21.5% in silver volumes on price gains of 3.1% and 5.8% respectively.

Platinum was quieter, in contrast, with London volumes 13.9% lower last week and prices trading little changed today from Tuesday, albeit in a $30 range around $1654 per Troy ounce − a new 12-year high when reached 5 sessions ago.

Palladium trading also dropped last week in London, down 4.0% from the prior week's 18.8% surge but with prices today rising to a fresh 2-year high at $1571.

Having launched what is now the USA's 5th largest gold-backed ETF trust fund (NYSEArca: SGOL), $490bn asset management group Aberdeen is now "looking beyond the recent surge in gold prices" to other metals, says professional investors magazine WealthDFM.

The trading division of $1.6 trillion gas and oil business Saudi Aramco (TADAWUL: 2222) "plans to hire copper traders as part of a push into metals markets," reported Bloomberg News from London's annual LME Week events yesterday, "joining a growing wave of energy giants moving into the sector."

"Energy traders are more speculative," says Fast Metals' special correspondent Andrea Hotter, also reporting from London Metals Week and quoting the CEO of multinational industrial commodities traders Trafigura.

"Their entry to metals markets naturally brings more liquidity [amid] the recent trend of new energy player entrants into metals."

Email us

Email us