Still No Gold Rush in Relentless Bull Market

Gold investing eases back on fresh record prices...

GOLD's run of fresh record prices is attracting strong numbers of new buyers, reports Adrian Ash at world-leading precious metals marketplace BullionVault.

But profit-taking by existing owners continues to off-set that demand. And inflows of new money, though strong, are well below the surges of the financial crisis or Covid pandemic.

With the Dollar price in August setting gold's 7th month-average record in 2025 so far, the number of new account openings on BullionVault beat August 2024 by 77.4%, marking the 4th strongest August in our fintech's 2-decade history.

But gold demand overall, net of selling, was practically zero by weight, and in total, the number of private investors buying gold across the month slipped 5.3% to the fewest since January, while the number of sellers dropped only 3.5% to the fewest since June.

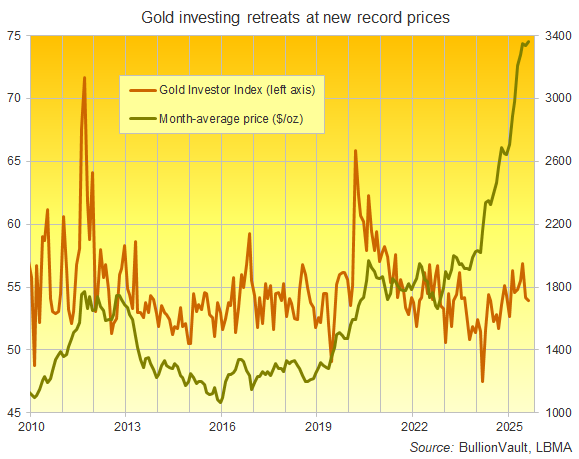

Together that cut 0.3 points off the Gold Investor Index to 53.9, the global index's lowest reading in 7 months.

Any reading above 50.0 signals more buyers than sellers across the month. The Gold Investor Index set a series low of 47.5 on heavy profit-taking in March 2024, hitting its highest in four years at 56.9 this June.

Launched in 2005 and finding 9-in-10 of its global client base in Western Europe and North America, BullionVault saw its users sell 5 kilograms more gold than they bought as a group in August, trimming total client holdings to a 3-month low just beneath 44.0 tonnes.

But while investor selling continues to offset new demand, the pace of profit-taking in gold investment continues to lag the pace of its price rise. That keeps taking the value of private investor holdings up to fresh all-time highs.

BullionVault customers' gold − all securely stored and insured in each client's choice of London, New York, Singapore, Toronto and (most popular) Zurich − rose in August to a new record value of $4.8 billion (£3.6bn, €4.1bn, JPY713bn), up by 30.9% since New Year (+21.9% in GBP, +16.8% in EUR, +22.7% in JPY).

The number of new BullionVault accounts opened meantime rose 6.7% in August from July's figure, and it beat the 12-month average by 13.8%, led by the UK (+20.3%), Germany (+16.5%) and Spain (+16.5%).

New US gold investing, however, remained muted again, slipping 14.3% from July and dropping 27.4% from its 12-month average.

This lack of US investor interest in gold might seem ironic given that President Trump is playing such a key role in driving up prices.

But while Trump's domestic, foreign and trade policies are clearly supporting further inflows to gold from central banks and Asian wealth, they're only part of a deeper, long-term fracturing of the global geopolitical system.

It's hard to see how the resulting mistrust and uncertainty won't continue supporting and driving gold prices higher, even as Western investors effectively sit it out, net-net.

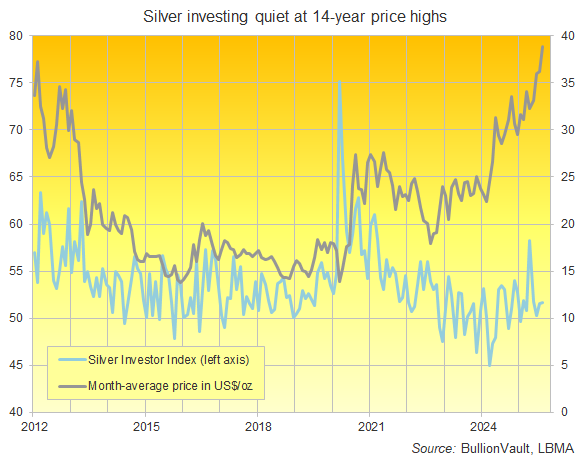

Silver investing also remained quiet overall in August as the more industrially-useful precious metal rose towards this week's fresh 14-year highs above $40 silver (and fresh all-time highs in UK Pounds above £30 per Troy ounce).

Unlike gold, the number of silver sellers fell harder than the number of buyers, down 28.1% versus 20.4% respectively as the more industrially-useful precious metal set its highest month-average price since September 2011.

Together, that edged the Silver Investor Index 0.1 points higher to 51.7, far below April's price-drop driven spike to a 4-year high of 58.3.

Silver also saw positive net demand by weight, growing BullionVault users' holdings by nearly 5 tonnes to a 3-month high of 1,157 tonnes, worth a new record $1.4bn (£1.0bn, €1.2bn, JPY212bn).

Bottom line? Gold's relentless bull market remains far from a gold rush, and silver's dramatic catch-up hasn't yet attracted a genuine flood of private investing either.

In both precious metals, the rise in demand is being matched by existing investors choosing to sell at gold's new all-time highs and silver's multi-year records.

Email us

Email us