Gold Supply 'n Demand: 'So What?' Says Price

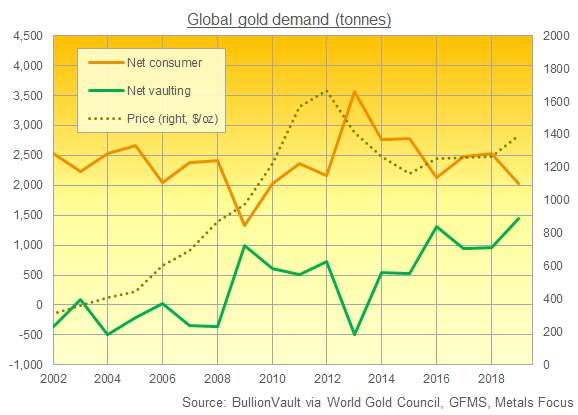

- The orange line tracks gold wanted as consumer products, whether jewelry, coins, small bars, bonding wire for the chips in your smartphone, or fillings for your teeth.

- The green line tracks what's left over – all of which, in the form that it's bought (or re-sold), comes in large wholesale-market bars, sitting in secure storage somewhere.

- Most crucially, the green line includes any 'surplus' between what the usual presentations report for supply exceeding demand. Because somebody must end up holding it. And like central banks growing (or cutting) their gold reserves, or gold-backed ETFs expanding (or shrinking) with shareholder interest, that 'surplus' will end up sitting in a vault somewhere, most likely in the form of 400-ounce Good Delivery bullion bars meeting the standards acceptable to central-hub London (and therefore the rest of the world's specialist vaults).

Email us

Email us