Gold Sets 5th Weekend High Running as Trump Seizes 'Shutdown Opportunity'

The PRICE of GOLD rebounded from yesterday's steep drop on Friday to set a fresh week-end record as the Dollar fell, global stock markets rose, and US President Trump moved to cut or close federal agencies amid the funding shutdown now blamed on his Democrat opponents by a raft of government department websites.

"I can't believe the Radical Left Democrats gave me this unprecedented opportunity," Trump tweeted yesterday on the TruthSocial media platform he owns.

The President then met Russ Vought − co-author of the Project 2025 program "for transforming the federal government and implementing conservative policies", and now director of the Office of Management and Budget − "to determine which of the many Democrat Agencies, most of which are a political SCAM, he recommends to be cut, and whether or not those cuts will be temporary or permanent."

With today's non-farm payrolls data from the Bureau of Labor Statistics delayed by the US government shutdown which started Tuesday night, the private-sector ISM survey for September said employment in the US services sector fell for the 4th month running.

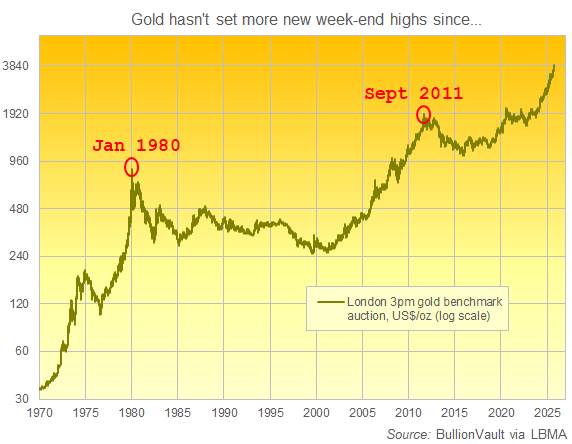

Gold traded at $3880 per Troy ounce as that news broke, some $15 below Thursday's fresh spot-market peak but rising 2.9% in US Dollar terms from last Friday afternoon in London's bullion market and setting the 5th new week-end record in a row.

That run was last beaten at gold's summer 2011 peak, and the New Year 1980 top before that. Both proved to be big long-term tops in the gold price.

"Perhaps gold prices now are showing the kind of movement that oil used to [in] acting as a barometer of global uncertainty," said Sanjay Malhotra, Governor of the Reserve Bank of India, at a conference today.

With exports to the US from India now hit by 50% trade tariffs, official data say the RBI has been the world's 4th heaviest gold-buying central bank so far this decade, behind China, Poland and Turkey.

"We see gold prices consolidating in 2026," says a note from French investment bank Natixis.

"[But] our upside risk suggests that if a 1% outflow from US money-market funds were to go into gold, then we could see prices at around $4300-4500 [and] the sacking of Fed governor Cook could also lift prices up."

Yesterday the US Supreme Court ruled that Lisa Cook, "fired" by President Trump in August, can continue as a governor of the Federal Reserve until it hears legal arguments in January.

"With more US rate cuts expected, we believe gold can break $4000 per ounce by year-end," says Swiss bank UBS.

"We see the gold price exceeding $4000 per ounce from the summer of next year onwards," says the global commodities team at US investment bank Goldman Sachs.

"Democrats Have Shut Down the Government," says a banner on both the White House and the Department of Justice's homepages, while the Treasury, while the Treasury, Department of Agriculture, and Department of Housing and Urban Development (HUD) blame the suspension of government funding on "the radical left".

On Wednesday, the Trump administration froze $26 billion of funding for programs in Democratic-voting states, including $18bn for transport in New York and $8bn for 'green energy' projects elsewhere.

On Thursday, White House press secretary Karoline Leavitt said that − in deciding which parts of government to cut or close permanently − Trump will choose "agencies that don't align with the administration's values."

"They are not stupid people," joked Trump about his Democrat opponents yesterday, blaming them for triggering the shutdown by refusing to back his Republican Party's proposal for a Continuing Resolution to keep funding running for federal agencies and departments.

"Maybe this is their way of wanting to, quietly and quickly, MAKE AMERICA GREAT AGAIN!"

With London bullion rebounding today from Thursday's gold price plunge, the price of silver rallied too, rising within 20 cents of yesterday's new 14-year highs above $48 per Troy ounce.

Gold also rebounded in all other major currencies, setting fresh weekend highs for UK and Euro investors at £2881 and €3304 respectively.

Email us

Email us