Gold Hits $5000 as Russia-Ukraine Talks Stall, Oil Jumps

GOLD PRICES jumped back to $5000 per ounce on Wednesday and silver erased all this week's previous 6.8% drop as oil prices rose after "tough" ceasefire talks between Ukraine and Russia ended early and US talks with Iran also made "progress" but no agreement.

Russia and Iran will tomorrow hold a joint naval exercise in the Gulf of Oman and northern Indian Ocean to "strengthen coordination" between their forces.

US President Donald Trump will meantime host the inaugural meeting in Washington of his so-called "Board of Peace" challenger to the United Nations, discussing the reconstruction of Gaza with attendees from most Middle Eastern nations − including Israel and Saudi Arabia − but no major Asian powers plus only Bulgaria, Hungary and Kosovo from Europe.

"Iran must never be able to develop a nuclear weapon," agreed Trump and UK Prime Minister Keir Starmer on a phonecall Tuesday, repeating "the need to work closely amongst allies and partners to improve regional security."

Aerospace and defense stocks rose today both on European bourses and in New York as Russia's President Vladimir Putin met with the foreign minister of "friendly and brotherly" Cuba - a "failed state" according to Trump, where the Communist Caribbean island's energy crisis is worsening following the US capture of oil-rich Venezuela's Nicolás Maduro this New Year.

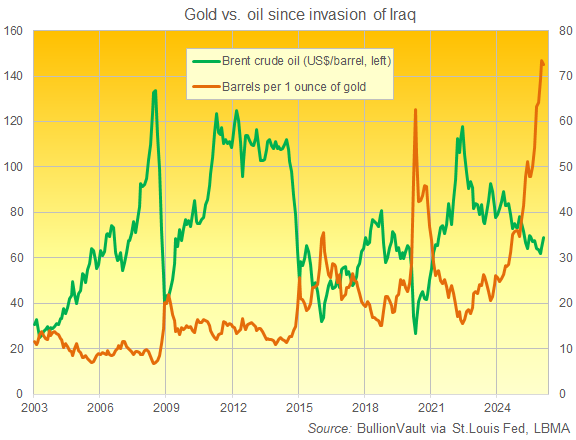

Now rallying by almost 1/5th from late-2025's near 5-year lows, crude oil today rose above $69 per barrel of European benchmark Brent.

Even with gold reclaiming the $5000 per Troy ounce level, that edged the price of bullion in terms of crude oil down by 1 barrel from January's month-average record of 73.5.

Natural gas prices meantime continue to drop in Europe on Wednesday, with March TTF contracts trading almost 1/4 lower for February so far

"Europe's natural gas stockpiles have fallen below one-third of storage capacity," says Russian energy giant Gazprom, warning its former customers that "currently, gas is being drawn from reserves accumulated in previous years."

But providing 40% of Europe's natural gas prior to the Kremlin's all-out assault on Ukraine 4 years ago next week, the giant Russian energy firm last year reported its worst-ever corporate loss, with exports to Europe since shrinking again to the lowest since 1973.

"A steady influx of [liquified natural gas] to Europe, combined with exceptionally weak Asian demand are keeping global natural gas prices low as the winter draws to a close," says LNG news site Natural Gas Intelligence.

"Long gold" is now the investment world's "most crowded trade" according to a series record 50% of respondents to Bank of America's global fund manager survey for February.

On average, however, the BofA respondents forecast gold prices will peak at $6200, with one-fifth of fund managers expecting it to reach $7000 - the same proportion who think gold has already peaked.

Priced in the Dollar, both gold and rich-world stock markets today traded at what were new all-time highs this time last month, with the precious metal down 11.0% from end-January's record peak while the MSCI World Index traded 1.8% beneath its early-February top.

Silver today shot back above $77 per ounce, rallying well over $5 from yesterday's 2-week silver price lows, reached as wholesale trading in No.1 precious metals consumer China has shut for the week-long Lunar New Year of the Horse celebrations.

Email us

Email us