Gold Gains as Stocks Drop, AI Investment 'Echoes DotCom Bubble'

GOLD and SILVER rallied from 1-week lows on Tuesday, erasing yesterday's drops as global stock markets fell for the 4th session running amid worsening investment anxiety over a bubble in AI capex led by "hyper scalers" Amazon, Google, Microsoft and Facebook.

"I think no company is going to be immune, including us," said Sundar Pichai, CEO of search-engine giant Google's parent Alphabet (Nasdaq: GOOG), when asked by the BBC this morning what will happen if the AI investment boom turns out to be a bubble and bursts.

Also warning consumers not to "blindly trust" in how AI chatbots respond to questions and prompts, "Look back at the internet [around the Tech Stock Crash starting in 2000]," Pichai said.

"There was clearly a lot of excess investment, but none of us would question whether the internet was profound. I expect AI to be the same."

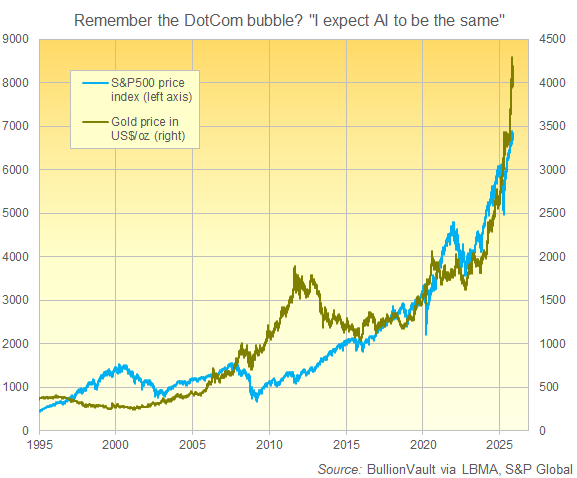

Gold prices fell throughout the DotCom boom and bubble of the late 1990s, before rising by over 22% as the S&P500 index halved over the 3 years to March 2003.

Over the past 12 months, in contrast, the precious metal has risen more than 55% while the S&P has gained 12% and GOOG's stock price has risen 60%.

Gold priced in the Dollar today rebounded more than $80 per Troy ounce after dipping below $4000, while silver rose nearly $1.50 to touch $50.83.

With 2025 capital expenditure on AI put around $125 billion at Amazon (Nasdaq: AMZN), $90bn at Alphabet, $80bn at Microsoft (Nasdaq: MSFT) and $70bn at Facebook (Nasdaq: META), those stocks − which take 4 of the top 7 spots for New York's most highly valued corporations − opened Tuesday almost 2% lower on average.

Shares in China's leading search engine Baidu (Nasdaq: BIDU) meantime extended their drop to almost 25% from early October's 2-year high after it reported 50% year-on-year growth in AI service revenues but a net loss overall for July-to-September.

Global equities also fell more widely, with the EuroStoxx 600 index down to its lowest since end-September as London's FTSE All Share hit a 4-week low, both dropping 3.7% from last Wednesday's new record highs.

Giant gold-backed ETF the SPDR Gold Trust (NYSEArca: GLD) yesterday saw net liquidation by shareholders cut the quantity of bullion needed by 2.5 tonnes towards a 2-week low at 1,041 tonnes.

World No.2 gold ETF the iShares Gold Trust (NYSEArca: IAU) was unchanged in size at its largest in over 3 weeks, as was iShares world No.1 silver-backed ETF (NYSEArca: SLV).

Silver prices in London today set the more industrially-useful precious metal's lowest midday fix in over a week around $50.30 per Troy ounce before extending its rebound from last night's low.

Gold had earlier seen its lowest 10:30 benchmark price since Friday 7 November, fixing around $4040 at London's AM auction.

Losing almost 10% since end-October's record high, AI chipmaker − and the world's most valuable company at $4.5 trillion − Nvidia (Nasdaq: NVDA) is due to report its third-quarter earnings tomorrow.

Wednesday will also bring meeting notes from the Federal Reserve's end-October interest rate cut of 0.25 points, when Trump appointee Stephen Miran called for a half-point cut while Kansas Fed president Jeffrey Schmid voted for no change.

That marked only the 6th time in 35 years that the usually unanimous Federal Open Market Committee split 3 ways, according to analysis by Reuters.

Wednesday will also bring August's US trade balance data from the Bureau of Economic Analysis, delayed almost 6 weeks by the US government shutdown which ended last Wednesday.

Thursday should then bring September's employment situation report from the Bureau of Labor Statistics, delayed since the start of October.

"Investors [are] fixated on the Big Tech," says a trading note from Swiss bullion refiners and finance group MKS Pamp's precious metals strategist Nicky Shiels, pointing to hyperscalers' "volatility, growth trajectory, capex plans, borrowing binges to build data centers, surging electricity demand.

"Whether its tech-bubble 2.0...[then] if/when bubbles burst, even gold wont be a store a store of value, initially."

Email us

Email us