Gold Price 'Not Selling Off' Despite Rising Real Yields Ahead of Fed June Rates Decision

GOLD PRICES fell and then bounced Monday as the US Dollar, bond yields and stock markets rose together, leaving bullion to fix around the lowest in 2 weeks at London's afternoon benchmarking auction as all eyes turned to this week's US Federal Reserve decision and forecasts for interest rates.

Silver also dropped and rallied, briefly dipping through $24 per Troy ounce, while crude oil sank to $72 per barrel of global benchmark Brent, retesting the spring's 2.5-year lows and more than reversing the gains it made after swing producer Saudi Arabia said in early April that it will slash its output by 1/10th from July.

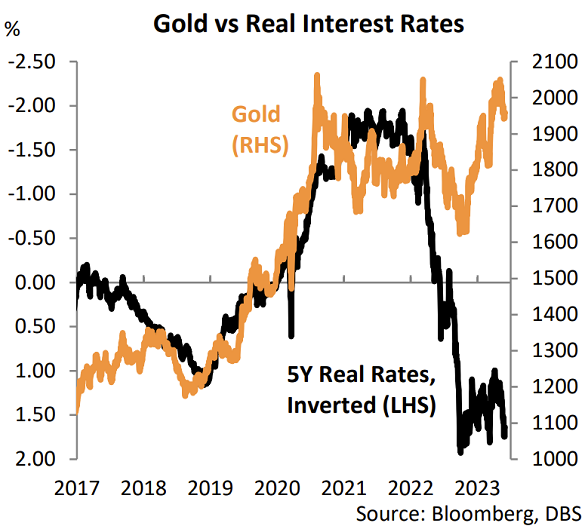

Ahead of the Fed, 10-year US Treasury yields rose to 3.77% per annum, up nearly half-a-percentage point from early April's 6-month low, and so-called real interest rates on 10-year inflation-protected Treasury debt – against which gold typically shows a strong inverse relationship – rose to 1.58%, matching last week's peak at the highest since before the US regional banking mini-crisis in March.

"Gold should be selling off," said Taimur Baig, chief economist at DBS Bank in its home city of Singapore last week in a presentation to the 6th Asia Pacific Precious Metals Conference, pointing to the steep rise in real US bond yields since the start of last year.

"But central banks are buying gold, sovereign wealth funds are buying, and jewelry demand's correction is ending" following China's reopening from 'zero Covid' social restrictions at the start of 2023.

Looking ahead, "Inflation is easing," Baig went on, suggesting that gold may also fall back if interest rates stay higher for longer.

But "a re-rating of gold prices may be in order [because] geopolitics is pushing investors and policy makers to consider tail risk hedges" for their portfolio.

Betting that the Fed will 'skip' a rate rise on Wednesday and hold its ceiling on overnight rates at 5.25% per annum rose Monday, putting the odds of no change at almost 4-in-5 according to the CME derivatives exchange's FedWatch tool.

Gold briefly dipped through $1950 per Troy ounce, trading exactly where it was when the Fed issued its March forecasts and repeated its prediction that year-end rates will be 5.1%, a level now finally reached by consensus forecasts in the CME futures market for December contracts.

Overnight, gold prices in No.1 consumer market China had earlier edged higher to offer new imports from London to Shanghai a $6 per ounce premium, but dealers in No.2 India continued to quote a $5 discount to landed import prices as the spring wedding season draws to a close, with zero auspicious dates on Hindu calendars from July through September.

Speculators in Comex gold futures and options last week raised their bullish betting on both gold and silver prices, data from US regulator the CFTC said late Friday, but the giant GLD and IAU gold-backed exchange traded ETF trust fund products both shrank slightly in size.

With the US Dollar rising on the currency market, the UK gold price today in Pounds per ounce rose £10 after hitting a new 13-week low at £1556.

Euro gold prices meantime bounced €5 per ounce from the lowest in 2 weeks at €1813 as traders looked ahead to Thursday's June decision from the European Central Bank, widely expected to bring another 0.25-point rise to 4.00% – the highest since the ECB raised rates into the Lehmans Crash phase of the global financial crisis in 2008.

Email us

Email us